The Basics: How to Create a Financial Plan

What you’ll learn:

- How to create a Financial Plan

- What is a Financial Plan?

- How to determine your Net Worth

- Key elements to include in your Financial Plan

What is a Financial Plan?

A financial plan is a blueprint illustrating your short and long-term financial goals and a strategy to successfully reach those goals. Each family’s financial plan will look a bit different. We all have different goals and ideas for how we want to spend our lives. In the same sense, there are some common elements beneficial for everyone! Those particular elements are what we’ll cover here. If you want to learn more about why a financial plan is important, go here.

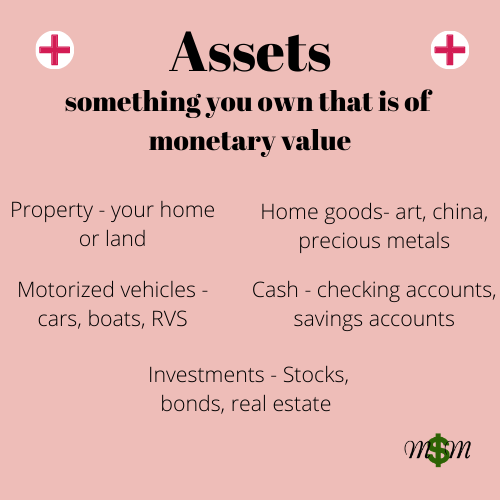

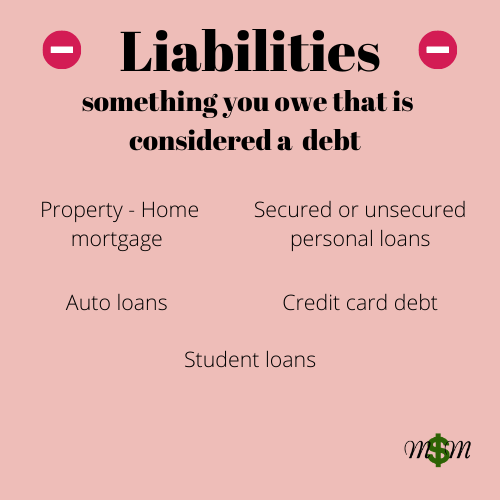

Determine Your Networth

Before we dive into the main elements of a financial plan, it’s important to mention something called your net worth. Your net worth is a measure of how much you and your family are worth. Your net worth determines the health of your financial state. Let’s break this down ..

ASSETS – LIABILITIES = NET WORTH

Why Your Networth is Important

Why is your net worth important? If your net worth comes out positive, reaching financial goals within your plan may be easier to attain. If your net worth comes out negative, then reaching financial goals may be challenging.

(Side note: I am absolutely aware your home is listed under both, the asset and liability column. You’ll include your home’s current value under the asset side and the amount you still owe on your mortgage under the liability side.)

There are multiple net worth calculators available. Here is a great place to plug in some quick numbers and have an idea of your net worth. As your asset column becomes more and more positive, goals such as college savings or real estate investing become more doable. When your liability column takes precedence, you’ll likely have to focus more on paying off debt and decreasing your output. Net worth sets the stage for how you should lay out your financial plan. Now let’s look at some key elements!

Key elements to a financial plan

1. Financial Goals

Goals determine how the rest of your plan is laid out. Short-term goals may include paying off your credit cards or paying your vehicle loan. Creating an emergency fund or saving for family vacation. Long-term goals are saving for retirement, paying for children’s college education, or creating multiple income streams.

2. Cash Flow

This is essentially your budget. You need to know how much money is coming in and going out. If you are spending more than you earn and/or have high interest debt, you will not be able to reach your financial goals.

3. Risk Management

Risk management includes all of your insurances. We don’t necessarily need many of these things until we do. From home owners insurance to health insurance to life insurance, insurance is important and a crucial part to your financial plan.

4. Savings

Have you ever heard the saying “pay yourself first?” Ideally, savings should be a part of your budget. Make sure you are paying yourself so that you can begin saving! From an emergency fund to college funds and beyond, a savings plan needs to be integrated in to your financial plan.

5. Investments

Investments are going to be your main source for building wealth. Employee retirement plans, individual retirement accounts, real estate, and personal stock options are a few examples of investment opportunites.

In Summary

Creating a financial plan is key for succeeding with financial goals. A great place to start with building out your financial plan is to include these key elements: financial goals, cash flow, risk management, savings, and investments.