The Basics: How to Create a Budget

What you’ll learn:

- What is a budget?

- Types of budgets

- How to create a budget that’s right for your family

What is a Budget?

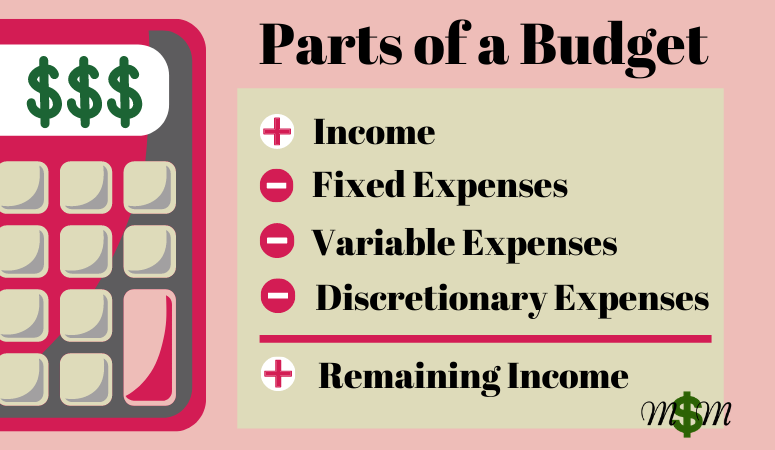

A budget is simply a plan for how you spend and save your money. A budget consists of your monthly income and a breakdown of how much money is allocated to particular categories. Your budget will be the backbone of your financial plan, no matter what your financial goals look like. Your budgeting system may change over time as your financial goals change, but a budget is absolutely necessary for financial success. To learn more about why a budget is so important, go here.

Types of Budgets

The 50/30/20 plan

Within the 50/30/20 plan, 50% of your income goes towards necessities, 30% goes towards wants, and 20% towards savings and debt. This is a nice, basic plan to calculate whether you are spending too much in certain areas and need to refocus your money. For instance, if your necessities can’t be met with 50% of your income, then you’d use income from the wants category to compensate.

the envelope system

The envelope system is a great option for those that need to follow a strict budgeting plan. While most mortgages and monthly utilities are automatically debited from accounts, the envelopes are used to keep the rest of your monthly spending under control. Envelopes for groceries, dining out, entertainment, home improvements, etc. The envelope system works well for those on a limited budget and for those looking to really pay down debt.

The zero based budget

The zero based budget literally takes all of your monthly income and gives a name to each dollar. If you’ve created your monthly budget and have $200 left over, then that $200 needs to be tasked. Otherwise, that $200 could just disappear. That’s $2,400 a year you could place into an IRA account. I plugged $2,400 annual contribution into a simple Roth IRA calculator. If you started age 35, retiring at 65, with a 7% return, that $2,400 annual contribution can grow into almost $250,000! Creating a zero based budget can seriously add up over time.

How to Create a Budget that’s Right for Your Family

So how do you decide on the best budget system for your family? This depends on the goals you’ve written for your financial plan. You could initially plug your income and expenses into the 50/30/20 plan to get an idea of where you may be overspending or underbudgeting. Then, use these percentages to best decide on your budget. If one of your goals includes paying off a great amount of debt, zero based budgeting would be beneficial. Any extra income left over could be allotted to debt repayment. If you are on a tight budget without much wiggle room, the envelope system may be the best option.

Our personal budget system

For years, our income was on a much tighter budget, and we used the envelope system and kept a notebook of our expenses. Envelopes truly hold you accountable for your spending, and we were able to look back through the notebook to see exact expenditures. The physical aspect of handing over cash (versus a debit card) and visually seeing on paper where we spent our money (versus an online data bank) made a big difference in our mentality about wasting money.

During this season, I keep our budget within a spreadsheet system. The spreadsheet is broken out in a 50/30/20 plan, and all of our income is accounted for similar to the zero based budgeting system. While we aren’t using the physical envelope system, we have separate debit cards for expenses. There’s a household card used for groceries, gas, dining out, etc. Then each adult has there own personal card with spend money for the month. This keeps us on track and works for our home right now.

I print off my spreadsheet each month to keep in a budget binder. This is part of my organizational system. I find having physical copies of my financial plan, budget, meal plans, etc. beneficial to staying abreast of our actual expenses. It’s much less easier for purchases to slip through this way!

In Summary

A budget will be the backbone for your financial plan. The three systems mentioned here are a great place to start. The 50/30/20 plan will give you a visual for where your income may be healthy or unhealthy. The zero based budgeting system will keep extra income from disappearing. The envelope system will keep the most strict budgeters on track.

I’ve created an editable spreadsheet that looks like my budget system. Just download, fill in, and print off to keep in your budget binder.